DOGECOIN the joke that became an investment

DOGECOIN INVESTMENT OPPORTUNITIES

INTRODUCTION

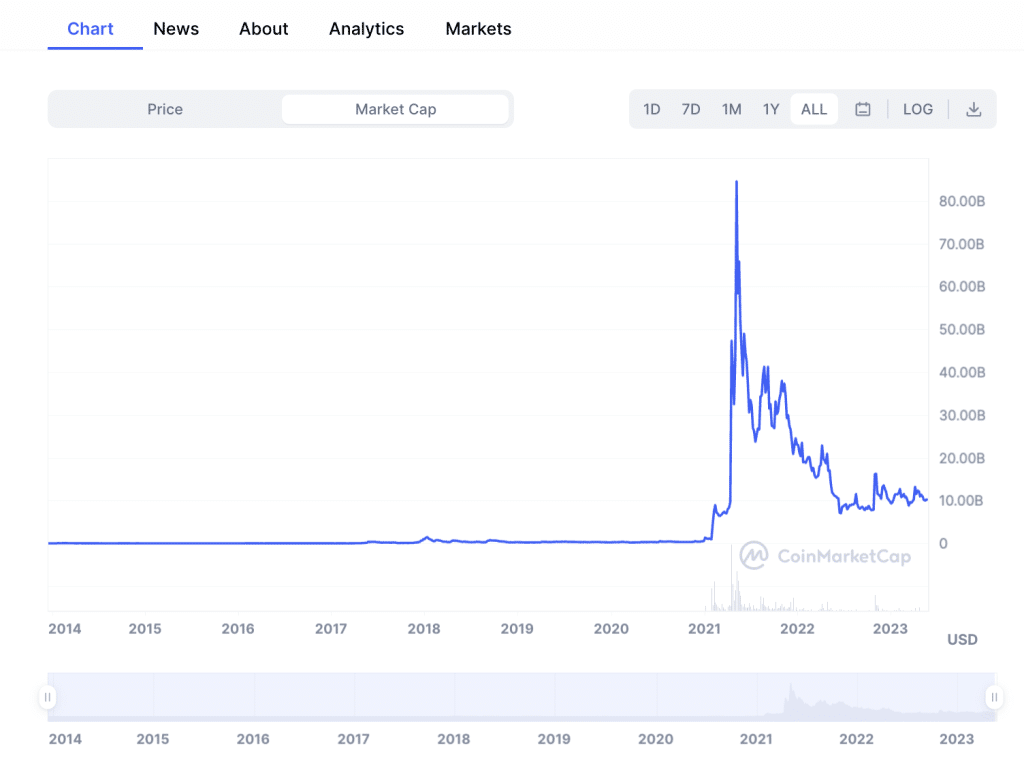

Dogecoin is a cryptocurrency that was created in 2013 as a joke based on the popular meme of a Shiba Inu dog. However, over the years, it has gained a loyal fan base and a significant market value. In 2021, Dogecoin reached an all-time high of $0.74, thanks to the support of celebrities like Elon Musk and Mark Cuban. As of August 2023, Dogecoin is trading at around $0.25, with a market capitalization of over $32 billion.

But is Dogecoin a good investment opportunity? What are the benefits and disadvantages of investing in this crypto currency? In this blog post, we will try to answer these questions and provide some insights into the future of Dogecoin.

Benefits of investing in Dogecoin

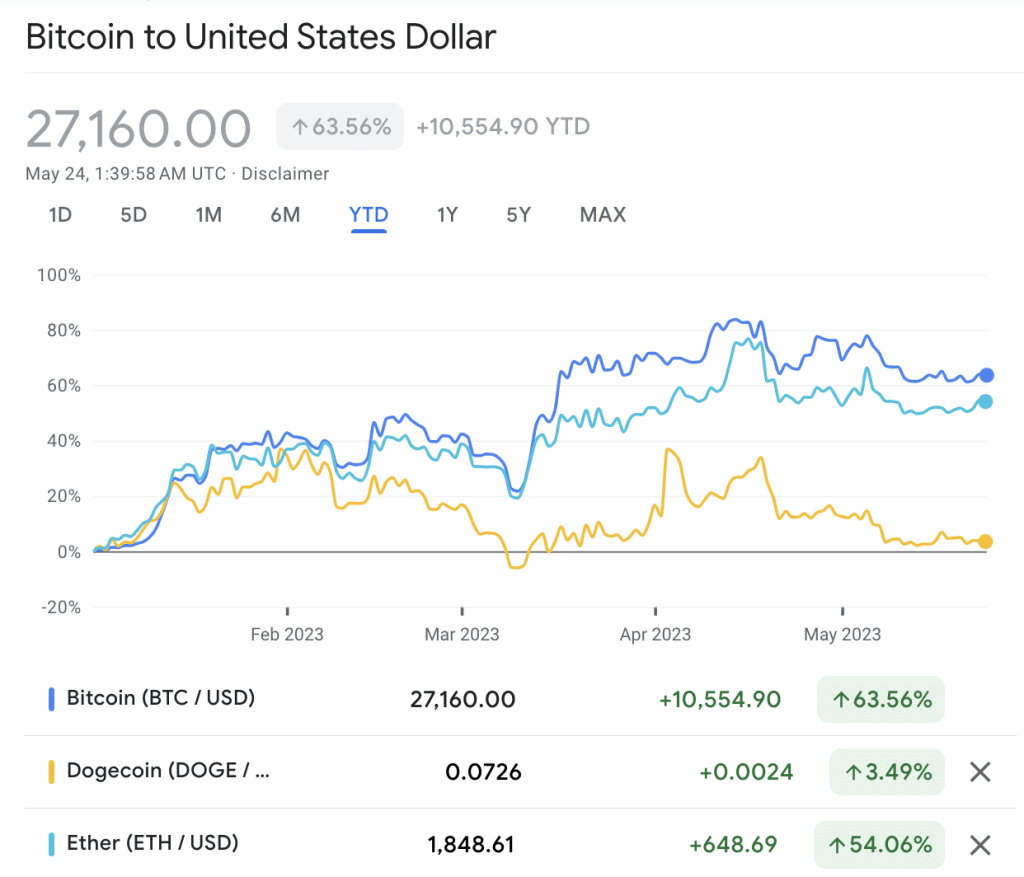

One of the main benefits of investing in Dogecoin is its low price and high liquidity. Unlike Bitcoin, which has a limited supply of 21 million coins, Dogecoin has no hard cap and produces 10,000 new coins every minute. This means that anyone can buy Dogecoin with a small amount of money and easily trade it on various platforms. Moreover, Dogecoin has a fast transaction speed and low fees, making it suitable for micropayments and tipping online.

Another benefit of investing in Dogecoin is its strong community and social media presence. Dogecoin has a loyal fan base that supports the coin and promotes it on various platforms. For example, Dogecoin users have donated to various charitable causes, such as funding the Jamaican bobsled team for the 2014 Winter Olympics, providing clean water to people in Kenya, and sponsoring a NASCAR driver. Furthermore, Dogecoin has received endorsements from influential figures like Elon Musk, who often tweets about the coin and calls it his favorite cryptocurrency.

A third benefit of investing in Dogecoin is its potential for growth and innovation. Dogecoin is based on the Litecoin codebase, which means that it can benefit from the technical improvements made by Litecoin developers. For instance, in 2019, Dogecoin implemented the Segregated Witness (SegWit) protocol, which increased its scalability and security. Additionally, Dogecoin developers are working on integrating the Lightning Network, which is a second-layer solution that enables fast and cheap transactions across different blockchains. Moreover, Dogecoin has the opportunity to expand its use cases and adoption by partnering with other projects and platforms. For example, in 2021, Dogecoin became the first cryptocurrency to be accepted by SpaceX as a payment for launching a lunar mission.

## Disadvantages of investing in Dogecoin

However, investing in Dogecoin also comes with some disadvantages and risks. One of the main disadvantages of investing in Dogecoin is its high volatility and unpredictability. Due to its low price and high supply, Dogecoin is susceptible to market fluctuations and speculation. Moreover, Dogecoin is heavily influenced by social media hype and celebrity endorsements, which can cause sudden spikes or drops in its value. For example, in May 2021, Dogecoin plunged by more than 30% after Elon Musk called it a "hustle" on Saturday Night Live. Therefore, investing in Dogecoin requires careful research and risk management.

Another disadvantage of investing in Dogecoin is its lack of development and innovation. Despite being one of the oldest cryptocurrencies, Dogecoin has not seen much progress or improvement in its technology or features. In fact, Dogecoin has only had four major updates since its inception, the last one being in 2019. Furthermore, Dogecoin has a small and inactive team of developers who do not have a clear roadmap or vision for the coin's future. As a result, Dogecoin may lag behind other cryptocurrencies that offer more functionality and utility.

A third disadvantage of investing in Dogecoin is its environmental impact and sustainability. Like Bitcoin and Litecoin, Dogecoin uses a proof-of-work (PoW) consensus mechanism, which requires a lot of computing power and energy to validate transactions and secure the network. According to Digiconomist, Dogecoin consumes about 0.12 kilowatt-hours (kWh) of electricity per transaction, which is equivalent to the power consumption of an average U.S. household for four minutes. Moreover, Dogecoin produces about 0.21 kilograms of carbon dioxide (CO2) per transaction, which is equivalent to the emissions of driving a car for 0.5 miles. Therefore, investing in Dogecoin may have negative consequences for the environment and climate change.

## Conclusion

In conclusion, investing in Dogecoin has both benefits and disadvantages that should be carefully weighed before making a decision. On one hand, Dogecoin offers low price, high liquidity, strong community, and potential for growth and innovation. On the other hand, Dogecoin suffers from high volatility, lack of development, and environmental impact. Ultimately, investing in Dogecoin depends on your personal preferences, goals, and risk tolerance. As always, do your own research and never invest more than you can afford to lose.

Comments

Post a Comment